Business

Top Benefits of Using Quality Wire Rope Lube in US Heavy Industry

In heavy-duty sectors across the United States, equipment reliability determines how safely and efficiently operations run. One essential maintenance product that crews rely on is wire rope lube, a specialised lubricant designed to protect steel ropes from friction, corrosion, and premature wear. Although it may seem like a small part of daily upkeep, choosing a high-quality formulation can significantly extend rope life and reduce risks on industrial worksites.

Essential Protection Against Wear

Wire ropes are constantly exposed to heavy loads, rapid movement, and abrasive contact points. Without proper lubrication, these ropes lose flexibility, internal strands weaken, and fatigue failures become more likely. High-grade lubricants penetrate deep into the core of each rope, coating individual wires so they move smoothly during operation. This reduces internal friction, one of the primary causes of structural deterioration. For industries like mining, construction, marine transport, and manufacturing, this added layer of protection helps ensure consistent and dependable performance.

Longer Rope Lifespan

Replacing wire ropes is costly—not only in terms of purchasing new equipment but also the downtime required for installation. Quality lubrication slows oxidisation, prevents moisture penetration, and reduces mechanical stress. When ropes remain well-protected, they can last significantly longer than ropes maintained with inferior or inconsistent products. For many companies, investing in premium lubrication results in substantial long-term savings because fewer replacements are needed throughout the year.

Improved Safety for Workers

Rope failures pose one of the most dangerous risks in heavy industry. A sudden break can cause dropped loads, equipment damage, and serious injuries. Proper lubrication makes ropes more predictable under tension and reduces the likelihood of snapping. Quality wire rope lube keeps strands flexible, preserves strength, and minimises the chance of hidden internal damage. This makes worksites safer and workers more confident in the equipment they handle daily.

Better Resistance to Harsh Environments

Across the US, wire ropes operate in extreme and varied conditions—from desert quarries and coastal ports to icy northern worksites. Saltwater, humidity, dust, and temperature swings all accelerate corrosion. High-performance lubricants are formulated to resist environmental stressors and create a moisture-blocking barrier. This protection is especially valuable in marine, offshore oil, and winter operations where ropes are exposed to severe weather or corrosive elements.

Reduced Equipment Downtime

Keeping operations running smoothly is a top priority in heavy industry. Poorly lubricated ropes often suffer from stiff movement, binding, and unexpected wear, which forces crews to halt work for inspections or repairs. Quality lubrication ensures consistent operation and reduces unnecessary stoppages. Many advanced lubricants also require fewer reapplications, which lowers labour time and allows maintenance teams to focus on other critical tasks.

Enhanced Performance in High-Load Applications

Certain applications, such as cranes, hoists, draglines, and winches, place extreme loads on wire ropes. Under these conditions, a lubricant must not only protect the rope but also withstand compression, pressure, and speed. Premium products are engineered to maintain their viscosity and protective qualities even in high-load, high-heat, or high-friction environments. This contributes to smoother lifting, steadier movement, and more efficient handling of heavy materials.

Cost-Effective Maintenance Investment

While quality lubricants may cost more upfront than basic alternatives, they pay off quickly through extended rope life, fewer repairs, reduced downtime, and improved reliability. For industries operating around the clock, avoiding just one rope failure can offset the entire lubrication budget. This makes quality lube a smart and strategic investment rather than just another maintenance supply.

Conclusion

Whether used in mining, construction, marine operations, or manufacturing, wire ropes play a vital role in US heavy industry. Protecting them with high-performance wire rope lube ensures safer operations, longer service life, better resistance to harsh environments, and improved financial efficiency. By prioritising the right lubrication products, companies can enhance both productivity and safety across every shift.

Business

Tips to Avoid Parking Fines in NYC

Parking in New York City can be challenging, given the dense traffic, fluctuating restrictions, and strict enforcement policies. With NYC’s stringent parking rules, even the most experienced drivers may encounter unintentional violations. Understanding common rules and best practices, along with using reserved spaces, helps reduce avoidable penalties. Here are some tips to avoid fines and make parking in NYC more manageable:

Pay Attention To Parking Signs

NYC streets and parking structures are filled with many different signs, each outlining different rules and restrictions regarding where you can or cannot park. These include signs that indicate:

- No Parking

- No Stopping

- Loading Zones

- No Standing.

Some signs are complex, and they contain more than one rule in a single post. These rules may also be tied to a specific day or time. Misreading these signs or overlooking a restriction sometimes results in a violation, leading to penalties.

Alternative side parking (ASP) signs are one type that can easily be misunderstood. ASP rules dictate when vehicles should be moved to allow for street cleaning. The enforcement of these rules varies by day, time, and location. Multiple ASP schedules sometimes apply to different sides of the same street, which can make the signs confusing.

Confirm the street cleaning schedule before leaving your vehicle to avoid fines or unnecessary trips back to move your car. If the signs seem unclear or contradictory, it may be safer to find another spot rather than risk misinterpreting the rules. Parking garages also offer a reliable alternative. They often have clearly defined rules, and they keep your vehicle off the street. This provides protection from street-cleaning restrictions.

Keep Track of Time Limits

When using metered parking, keep track of the meter’s time limit and payment status. Most metered spaces enforce strict rules, and failing to pay or letting the meter expire tends to result in violations. Some locations impose strict maximum parking durations that prevent car owners from extending their time beyond a certain limit, even if the meter is paid. For such spaces, you can set a reminder on your mobile phone a few minutes before your meter expires. This gives you time to return and move your vehicle before traffic agents start imposing fines.

In some locations, including garages and privately managed parking facilities, you may find systems that allow remote time extensions through mobile apps or automated kiosks. This option lets you extend your time up to a specified limit without returning to your vehicle. Before leaving your car, review posted instructions or signage to confirm whether time extensions are permitted. If a payment machine is not working or does not accept payment, choose another space or facility to avoid potential violations and disputes.

Follow Proper Parking Guidelines

Using designated parking spaces helps prevent significant fines, and it avoids blocking traffic or access points. Avoid double parking by making sure your vehicle remains fully within marked spaces. Stay clear of fire hydrants, crosswalks, bus stops, and bike lanes. Improper parking can result in tickets, and it creates potential safety hazards for pedestrians and other drivers. Paying attention to curb markings also enables you to avoid unnecessary fines. In some areas of NYC, curb colors indicate specific vehicle restrictions. Red curbs typically mean no stopping, while blue curbs designate accessible parking spaces. Recognizing these visual cues can help you avoid restricted zones, even when signage is limited.

Reserve a Space in Advance

Some apps and websites allow you to reserve parking spaces in NYC ahead of time, typically in private garages or managed lots. Reserving in advance helps secure a legal and reliable place to park; this can reduce the risk of tickets. Pre-booking also minimizes the time spent searching for parking, especially during peak traffic hours.

Designated parking garages provide a monitored environment for leaving your vehicle for extended periods while you complete your activities in the city. Because garages vary in time limits and vehicle size restrictions, review each facility’s rules before reserving a space. Choosing garages that are conveniently located, well-lit, staffed, and secure can improve both safety and convenience. If you drive frequently in the city, joining a monthly program at a garage helps offer added value and flexibility.

Find Convenient Parking in NYC

Staying aware of parking rules is key to avoiding fines in NYC. While street parking may seem convenient, it comes with complex and strict regulations that vary by location, time, and day. Taking the time to understand posted signs and restrictions helps reduce unnecessary tickets; using garages and reserving spaces in advance is also beneficial. Contact a professional parking provider to secure a safe, legal, and reliable spot for your car.

Business

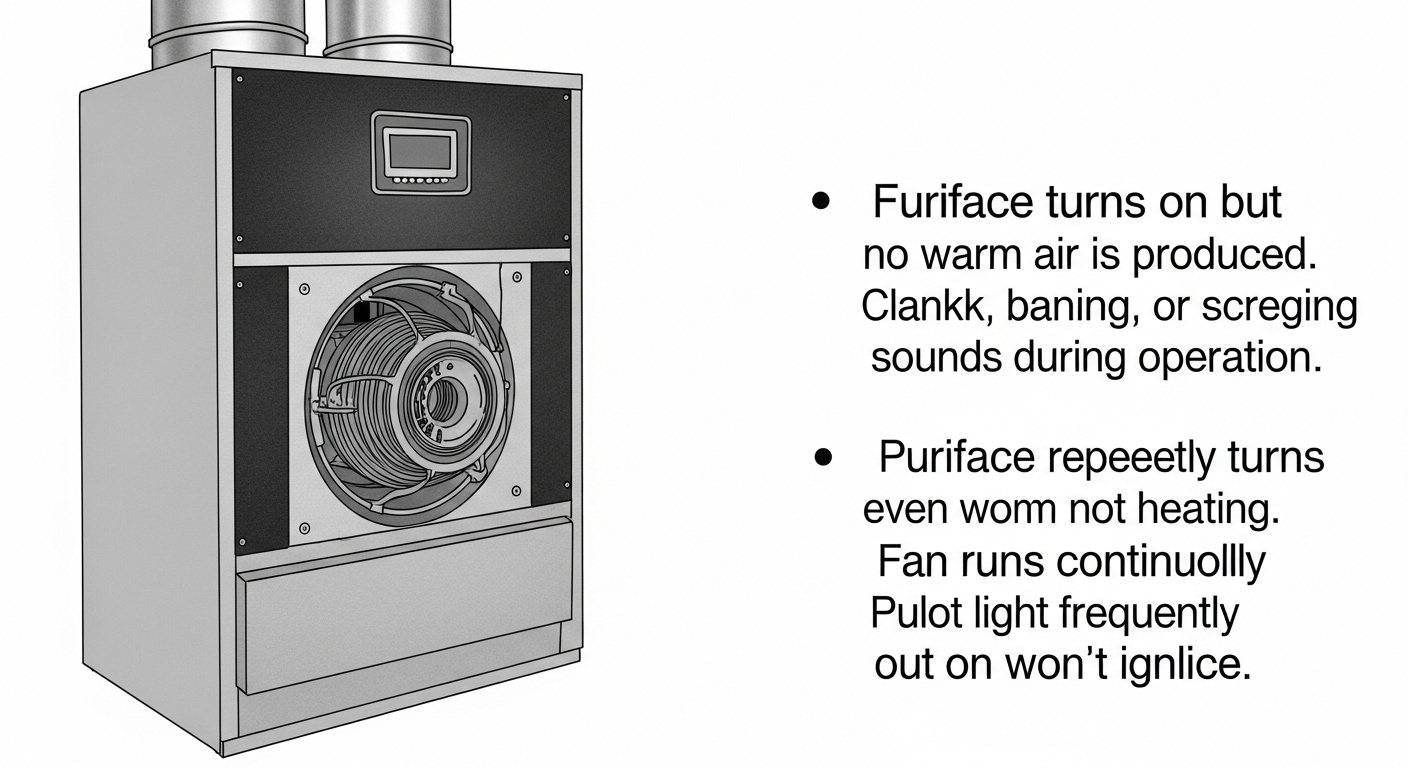

Common Issues That Require Furnace Repair

Qualified HVAC technicians can accurately identify and address furnace problems early on, preventing minor issues from escalating into major system failures. Repairs make sure your unit operates safely and at peak efficiency, and this promotes optimal heating throughout the year. Understanding the most common furnace problems helps you identify when it’s necessary to call a professional for assistance. Here are some common issues that require furnace repair:

Dirty or Clogged Air Filters

Air filters trap dust, pet dander, pollen, and other airborne particles, preventing them from entering the furnace’s internal components. Once the filters become dirty or clogged, they restrict airflow. This results in the system working harder to maintain efficient circulation of warm air throughout the house.

Reduced airflow can cause the furnace to overheat, triggering the limit controller, which shuts down the system as a safety measure. This problem creates a cycle where the furnace runs briefly, shuts down, and then restarts after it has cooled down. Filter replacement addresses minor issues, but professional repair can help assess other widespread related damages. Air filter repair improves heating efficiency and also promotes safe and reliable performance.

Faulty Thermostat

The thermostat serves as the command center of the furnace; it tells the system when to turn on or off to maintain the desired indoor temperature. When the thermostat is faulty, it sends incorrect signals to the furnace, resulting in inconsistent heating or no heat at all. A bad thermostat may also cause the system to cycle on and off frequently or shut down prematurely.

Thermostat malfunctions are sometimes triggered by dead batteries, calibration errors, faulty wiring, or older models that aren’t compatible with modern systems. Smart and programmable thermostats may experience another level of malfunctioning related to software glitches and programming issues. Professional furnace repair helps identify whether the problem lies within the thermostat itself or with its connection to the heating system. Addressing thermostat issues can restore efficient communication with the system, and this supports efficient temperature controls throughout the seasons.

Ignition Failure

The ignition system creates the flame that heats your home, and when it fails, you may be left in the cold. Modern furnaces use electronic ignition systems, while older gas models have pilot lights that must remain lit at all times. Signs of ignition failure include the pilot light constantly going out, intermittent heating, and burners clicking without lighting. Ignition problems pose potential safety risks because they involve gas and combustion. They require professional handling by qualified technicians. Failed ignition leaves the home without heat, but it can also strain other furnace elements as they repeatedly attempt to start the system.

Bad Heat Exchanger

A heat exchanger is the component that safely transfers heat from the flame and warms the air that is circulated in the house. It is responsible for separating combustion gases from the heated breathing air. A cracked or broken heat exchanger can allow cold air or combustion gases to escape into your house. When cold air leaks in, it disrupts heating, but when harmful gases such as carbon monoxide are released, they pose serious health and safety concerns.

Signs of a faulty heat exchanger include carbon monoxide alarms going off and strong, unpleasant odors. You may also notice soot buildup around your furnace and yellow or flickering burner flames. Heat exchanger problems are sometimes triggered by corrosion from combustion elements, chronic overheating, and poor maintenance. Professional furnace repair services help restore system performance and household safety.

Faulty Blower Motor

The blower motor is responsible for transferring heated air from the furnace into your home through the vents. If the motor fails, the furnace won’t efficiently distribute the heated air it creates; this makes it hard to maintain consistent indoor temperatures. When a blower motor fails, you may notice unusual whirring, rattling, or squealing noises. Some furnaces also continue to run without circulating warm air.

A faulty motor may add strain to other parts of the furnace and increase energy consumption as the system works harder to force air out. Possible causes of motor issues include general wear from prolonged use, worn-out bearings, overheating, and electrical problems. Professional repairs help evaluate whether the motor needs replacement or lubrication to restore reliable performance.

Hire a Professional Furnace Repair Company

Common furnace problems can increase energy consumption, reduce comfort, and pose serious health and safety risks. Professional furnace repair helps address these issues by restoring operational efficiency and reliability. Technicians may also identify hidden problems, such as cracked heat exchangers or faulty wiring, and this helps promote household safety. Hire a reliable furnace repair provider to explore solutions that meet your heating needs.

Business

What to Look For When Evaluating Your Bar Insurance Policy

Establishments such as bars and nightclubs are exposed to risks such as customer injuries on the premises, alcohol-related incidents, property damage, and more. The right bar insurance policy protects you against financial losses caused by these events by providing clear liability coverage. The policy should align with the bar’s daily operations and risk profile. When assessing your bar’s insurance needs, evaluate these factors:

Coverage Types

A broad coverage bar insurance policy, such as general liability, liquor liability, commercial property, and business interruption, helps make sure your bar is equipped to handle a variety of risks. Liability coverage protects your bar if someone is injured or their property is damaged on the premises. General liability specifically covers incidents such as slips, falls, or other accidents that may occur while guests are visiting.

Liquor liability protects you when overserved guests cause harm, whether through accidents or other incidents on your premises. Workers’ compensation covers injuries to staff, including burns or strains from lifting heavy objects in the bar. Commercial property insurance safeguards your inventory, furniture, and fixtures against risks like fire or theft of liquor stock. If a covered event forces your bar to close, business interruption coverage helps replace lost income. Equipment breakdown coverage is designed to protect necessary systems, such as refrigerators and draft lines, if they suddenly fail and disrupt service. Evaluate your business’s needs and risks before selecting a coverage type.

Policy Terms

Reviewing your insurance provisions carefully helps prevent claim denials caused by unclear rules or misaligned timelines. The policy period specifies the exact start and end dates of coverage, so it is necessary to make sure there is no gap between this policy and any prior coverage. Policies may be either claims-made or occurrence-based.

Claims-made policies cover only claims filed during the policy period, whereas occurrence-based policies cover incidents that happen during the policy period, regardless of when they are reported. Notice requirements often mandate prompt reporting of incidents to maintain uninterrupted coverage. Because some insurers impose strict deadlines, it is key to align policy timelines with your bar’s operations.

Endorsements and riders modify the original policy wording to add, restrict, or clarify coverage for specific exposures. Such exposures include hiring live entertainment or renting outdoor service areas. Review each endorsement carefully to determine the applicable limits and the conditions your bar must meet for a claim to be honored.

Policy Exclusions

Exclusions are specific situations or events that an insurance policy does not cover. Most bar insurance policies exclude intentional damage caused by owners or staff, normal wear and tear, failures in routine maintenance, and certain natural perils, such as floods, earthquakes, or mold. Some policies also limit or exclude assault and battery claims if inadequate security measures contributed to the incident, such as poor crowd control.

Insurers may restrict liquor liability coverage if alcohol is served without the proper licenses, to minors, or to visibly intoxicated patrons in violation of the law. Understanding these exclusions is necessary for identifying operational risks and implementing internal controls, including staff training and compliance procedures. By reviewing exclusions carefully, bar owners may reduce the chance of denied claims and verify that their risk management strategies align with the policy’s limitations.

Claims Processes

The claims process is a step policyholders follow to request payment from an insurance company after a covered loss. It describes how you report an incident and which channels you use. Examine how the insurer handles claims after they are reported, including having an adjuster assigned and evaluating liability and damages. Required documentation may include incident reports, photos, receipts, and proof of preventive measures, like staff training logs or equipment maintenance records.

Safety Standards

Some bar insurance policies include conditions or recommendations to reduce risk and support coverage. Start by reviewing security-related requirements, such as ID verification and operational surveillance cameras. Policies may also include alcohol-service expectations like responsible beverage service training and adherence to local liquor laws. If your bar’s policy includes employment practices liability, review the terms carefully, and confirm whether written harassment and discrimination policies are required.

Find the Right Bar Insurance Solutions

Professional bar insurance services provide coverage for liquor-related accidents, property damage, and employee-related risks. Experts identify any gaps in coverage and align your policy terms with alcohol service regulations and operational activities. Contact bar insurance specialists today to review your coverage options and get a suitable policy for your establishment.

-

Technology4 months ago

Technology4 months agoYourAssistantLive com: The Future of Smart Digital Assistance

-

food4 months ago

food4 months agoCalamariere: How to Perfectly Prepare at Home

-

Blog4 months ago

Blog4 months agoBaddi Hub: An Emerging Industrial and Business Hotspot

-

Blog4 months ago

Blog4 months agoSimpcit6: Redefining Simplicity in a Complex World

-

Health3 months ago

Health3 months agoNerovet AI Dentistry: Enhancing Patient Experience and Treatment Outcomes Dental Care

-

Technology3 months ago

Technology3 months agoVoomixi com: The Digital Platform Redefining Online Interaction

-

Crypto4 months ago

Crypto4 months agoCrypto30x.com vs Other Crypto Sites – Best Bitcoin Tools?

-

Lifestyle4 months ago

Lifestyle4 months agoPyjamaspapper: The Ultimate Blend of Comfort and Style in Sleepwear