Loans

Handle Unexpected Expenses Fast with Short-Term Funding

Unexpected expenses can shake even the most carefully planned budget. Life’s surprises—like sudden medical bills, car breakdowns, or urgent home repairs—can leave you searching for a timely solution. For many, short-term loans can serve as a financial lifeline, helping to bridge the gap when unexpected emergencies arise. In such moments, options like MaxLend loans offer access to fast funds to cover pressing costs, providing relief when you need it most.

Being able to address emergency spending needs quickly can be essential to maintaining stability, especially if you lack significant savings. While some may be hesitant to borrow, responsibly managed short-term loans can play a vital role in patching financial holes and protecting your standard of living during stressful times.

Nevertheless, relying solely on borrowing isn’t always ideal. Short-term loans should be used judiciously, and borrowers should have a clear understanding of loan terms, interest rates, and repayment schedules. This article provides an in-depth overview of how short-term loans function, the types of unplanned expenses they can help you manage, and best practices for borrowing responsibly.

Learning about these options empowers you to make informed choices under financial pressure and helps you navigate the stormy waters of unplanned expenses with confidence. For those interested in understanding personal loan terms or borrowing practices, resources from the Consumer Financial Protection Bureau can be a reliable source for further reading.

Understanding Short-Term Loans

Short-term loans are a type of unsecured borrowing designed to help individuals cover immediate, often unexpected, expenses. Typically, these loans require no collateral and have a repayment window that may range from a few weeks to several months. Application processes are straightforward, and approval times are usually rapid, making these loans a fast solution during emergencies. Interest rates and fees can be higher compared to traditional loans, reflecting the lender’s risk and the need for quick disbursement.

Common types of short-term loans include payday loans, cash advances, and installment loans. Each has its own features and lending criteria, but the unifying characteristic is quick access to funds. As with any financial product, it’s critical to review the specific terms, including fees and interest rates, to determine the total cost of borrowing.

Common Unplanned Expenses

Unplanned expenses often come at the worst possible time, typically when your budget is already stretched. Here are some examples of sudden costs you may face:

- Medical Emergencies: Hospital visits, urgent care, or surgery can quickly accrue significant bills, especially if insurance coverage is lacking or limited.

- Home Repairs: From broken heaters during winter to burst pipes and electrical malfunctions, home repairs often require immediate attention and financial resources.

- Vehicle Repairs: Car breakdowns, flat tires, or unexpected maintenance costs can disrupt your commute and daily life, requiring prompt fixes.

- Job Loss: Losing your source of income can rapidly make it hard to cover essential bills while you search for new employment.

- Emergency Travel: Sudden family emergencies, out-of-town funerals, or last-minute flights can create a pressing need for extra funds.

These kinds of expenses not only create financial strain but can also cause emotional stress. Acting quickly on these emergencies is crucial to minimizing both immediate hardship and long-term financial consequences.

Benefits of Short-Term Loans

Fast Access to Cash

The primary benefit of a short-term loan is the ability to secure funds within one or two business days, which can be critical in emergencies. This quick turnaround is especially helpful when waiting for a paycheck or when arranging alternative funding is not possible.

Versatility and Flexibility

Funds from short-term loans can be used for a wide variety of needs—from medical expenses to fixing your car. This flexibility enables borrowers to address any emergency that arises, rather than being restricted to a narrow category of costs.

Preserving Your Financial Health

By using a short-term loan to stay current with payments, you can protect your credit score from damage caused by late payments. This can prevent a small emergency from spiraling into long-term debt or financial hardship. For more financial health tips, NerdWallet’s guide to personal loans offers an in-depth look.

Responsible Borrowing Practices

While short-term loans offer relief, borrowing wisely is essential to avoid financial pitfalls:

- Only Borrow What You Need: Calculate the exact amount necessary to cover your emergency, and don’t be tempted by higher loan limits.

- Know the Terms: Review interest rates, fees, repayment periods, and prepayment policies so you’re not caught off guard. This transparency is key to responsible borrowing.

- Repayment Planning: Budget carefully to ensure on-time payment. Missing deadlines can result in steep penalties and damage to your credit score.

Alternatives to Short-Term Loans

Short-term borrowing shouldn’t be your first or only option. Consider these alternatives:

- Emergency Savings: A well-established emergency fund is the most reliable shield against unplanned expenses.

- Credit Cards: For minor expenses, a credit card with a manageable interest rate might be a better choice—if you can pay the balance off promptly.

- Assistance Programs: Some charities, nonprofits, and government agencies offer grants or low-interest loans to cover medical bills, home emergencies, or basic living expenses.

Conclusion

Unplanned expenses don’t have to derail your financial stability. With knowledge and careful planning, options such as short-term loans can provide rapid support in emergencies. Always borrow responsibly, keeping in mind interest costs and your repayment plan. Building up your savings and exploring other resources—such as community programs and credit cards—will go a long way toward strengthening your financial resilience and reducing your future reliance on borrowing.

Loans

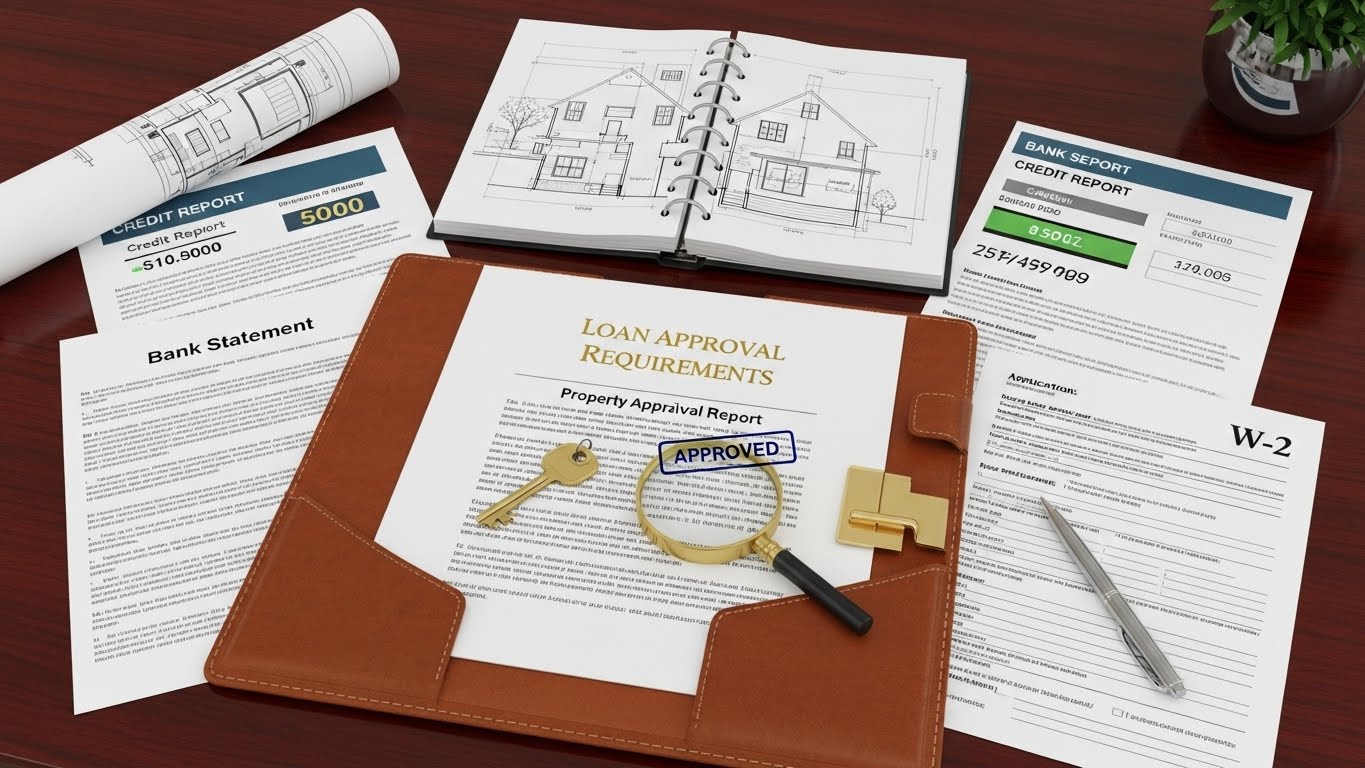

Key Property Standards Required for Loan Approval

Securing a home loan is one of the most significant milestones in life, and for many buyers, an FHA loan is the key to unlocking homeownership. However, these government-backed loans come with a specific set of strict requirements regarding the property’s condition. Navigating these standards can feel overwhelming for borrowers, lenders, and builders alike.

Whether you are a mortgage lender requiring detailed documentation for closing, or a homebuyer wanting to ensure your potential property is up to code, understanding the inspection process is vital. A professional FHA home inspection is the bridge between a property’s current state and final loan approval.

In the Dallas-Fort Worth area and beyond, Art Neidich Property Inspection & Consulting stands out as a leader in navigating these complex regulations. With decades of experience, we ensure that the path to closing is smooth, compliant, and free of surprises.

Decoding the FHA Compliance Inspection

It is a common misconception that all home inspections are the same. A standard home inspection typically provides a general overview of a home’s condition for the buyer’s knowledge. In contrast, an FHA compliance inspection is far more specific. It is designed to verify that a property meets the U.S. Department of Housing and Urban Development (HUD) Minimum Property Standards.

These inspections focus on three main pillars: safety, security, and structural soundness. The goal is to protect the lender’s investment and ensure the buyer is moving into a habitable home.

The Critical Role of the 92051 Form

One of the most essential components of this process is the FHA/HUD 92051 reporting. This is not just a checklist; it is a formal document required by lenders to verify compliance.

At Art Neidich Property Inspection & Consulting, we specialize in providing accurate FHA/HUD 92051 reporting. Our reports are meticulous, ensuring that every necessary detail is documented correctly the first time. This level of accuracy is crucial for lenders who need to move files through underwriting without unnecessary delays or kickbacks.

Why Experience Matters in Compliance

When dealing with federal regulations, experience is your best asset. Rules can be nuanced, and misinterpreting a building code or an FHA requirement can lead to costly delays.

Art Neidich Property Inspection & Consulting brings over 45 years of hands-on experience in the construction and inspection fields. Being an ICC Certified Building Official and a Residential Combination Inspector means we bring a depth of knowledge that goes beyond a basic checklist. Since registering as an FHA fee inspector in 2008, we have helped countless clients navigate the evolving landscape of property standards.

This expertise allows us to:

- Identify potential compliance issues early in the process.

- Provide clear, actionable feedback to builders and sellers.

- Deliver reports that underwriters trust implicitly.

Going Beyond City Limits: Serving Rural Texas

A significant challenge for many developers and homebuyers in Texas is finding reliable inspection services outside of major metropolitan hubs. Many municipal inspectors are limited to their specific jurisdictional boundaries, leaving properties in unincorporated areas or rural developments without consistent oversight.

We fill this gap. Our team is certified and ready to perform inspections anywhere in the county. Whether your project is in the heart of Dallas or in a developing rural community, we ensure the property complies with adopted Residential Building Codes and applicable FHA guidelines.

This “beyond city limits” service is invaluable for those building or buying in the expanding territories of Texas, ensuring that rural living doesn’t mean compromising on safety or compliance standards.

Streamlining the Loan Approval Process

In real estate, time is money. Delays in receiving inspection reports can push back closing dates, causing stress for buyers and logistical headaches for lenders. Efficiency is a core part of our service philosophy.

Fast Turnaround Times

We understand the pressure lenders and builders face. That is why we prioritize prompt delivery of our reports. In many cases, we provide the FHA/HUD 92051 form and comprehensive photographic documentation within 24 to 48 hours of the inspection.

Dedicated Coordination

Navigating schedules can be just as difficult as the inspection itself. Our dedicated service coordinators, Kamalin Neidich and Ashley James, are known for their rapid response times and expert scheduling. They understand the FHA process inside and out, ensuring that from the moment you call or email, your project is handled with priority and care.

More Than Just FHA: Comprehensive Code Compliance

While an FHA home inspection is a major part of our business, our expertise extends to broader building code compliance. We offer custom code inspection packages tailored for:

- Developers: Ensuring entire subdivisions meet standards.

- Builders: Providing reliable third-party verification during construction phases.

- Mortgage Companies: guaranteeing that the asset backing the loan is secure.

From foundation pours to the final walkthrough, we provide the impartial verification that keeps projects moving forward.

Frequently Asked Questions

What areas do you service?

We proudly serve a wide range of Texas communities including Dallas, Fort Worth, Arlington, Plano, Frisco, Garland, Irving, Denton, McKinney, Mesquite, Waco, Tyler, and Sherman. We also specialize in serving unincorporated and rural areas surrounding these cities.

Do I need a specific inspection for an FHA loan?

Yes. FHA loans require specific compliance inspections to ensure the home meets HUD’s Minimum Property Standards regarding safety, security, and structural integrity. Standard home inspections may not cover these specific federal requirements.

How quickly can I get my report?

We understand the urgency of real estate transactions. Our goal is to deliver FHA/HUD 92051 reports and photo documentation promptly, often within 24 to 48 hours after the inspection is completed.

Can you perform inspections for new construction?

Absolutely. We work closely with builders to perform phase inspections and final compliance inspections, ensuring new construction projects meet all necessary codes and FHA standards before closing.

Secure Your Investment with Confidence

The inspection process should be a source of confidence, not anxiety. By choosing a team with deep experience, broad geographic reach, and a commitment to speed, you ensure that your property transaction remains on track.

Whether you are a lender looking for a partner who understands underwriting needs, or a builder requiring third-party code verification in a rural area, Art Neidich Property Inspection & Consulting is ready to help. Don’t leave compliance to chance. Contact us today to schedule your inspection and experience the difference that professional expertise makes.

-

Blog2 weeks ago

Blog2 weeks agoSimpcit6: Redefining Simplicity in a Complex World

-

Technology5 months ago

Technology5 months agoYourAssistantLive com: The Future of Smart Digital Assistance

-

food5 months ago

food5 months agoCalamariere: How to Perfectly Prepare at Home

-

Blog5 months ago

Blog5 months agoBaddi Hub: An Emerging Industrial and Business Hotspot

-

Health4 months ago

Health4 months agoNerovet AI Dentistry: Enhancing Patient Experience and Treatment Outcomes Dental Care

-

Technology2 weeks ago

Technology2 weeks agoVoomixi com: The Digital Platform Redefining Online Interaction

-

Crypto5 months ago

Crypto5 months agoCrypto30x.com vs Other Crypto Sites – Best Bitcoin Tools?

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoPyjamaspapper: The Ultimate Blend of Comfort and Style in Sleepwear